WaterEquity is an asset manager with an exclusive focus on ending one of the most urgent issues of our time—the global water and sanitation crisis.

WaterEquity identifies investment opportunities in the water and sanitation sector that offer competitive risk-adjusted returns and measurable social impact. More specifically, we invest in financial institutions to help them scale their water and sanitation microlending portfolios. We also invest in enterprises and infrastructure in emerging markets delivering access to safe water and sanitation solutions to low-income communities.

We provide opportunities for investors to earn a competitive financial return while making responsible and sustainable investment choices that have a multifold impact across many of the United Nations Sustainable Development Goals, such as driving economic growth, supporting healthy communities and ecosystems, enhancing resilience to climate change, and promoting gender equality.

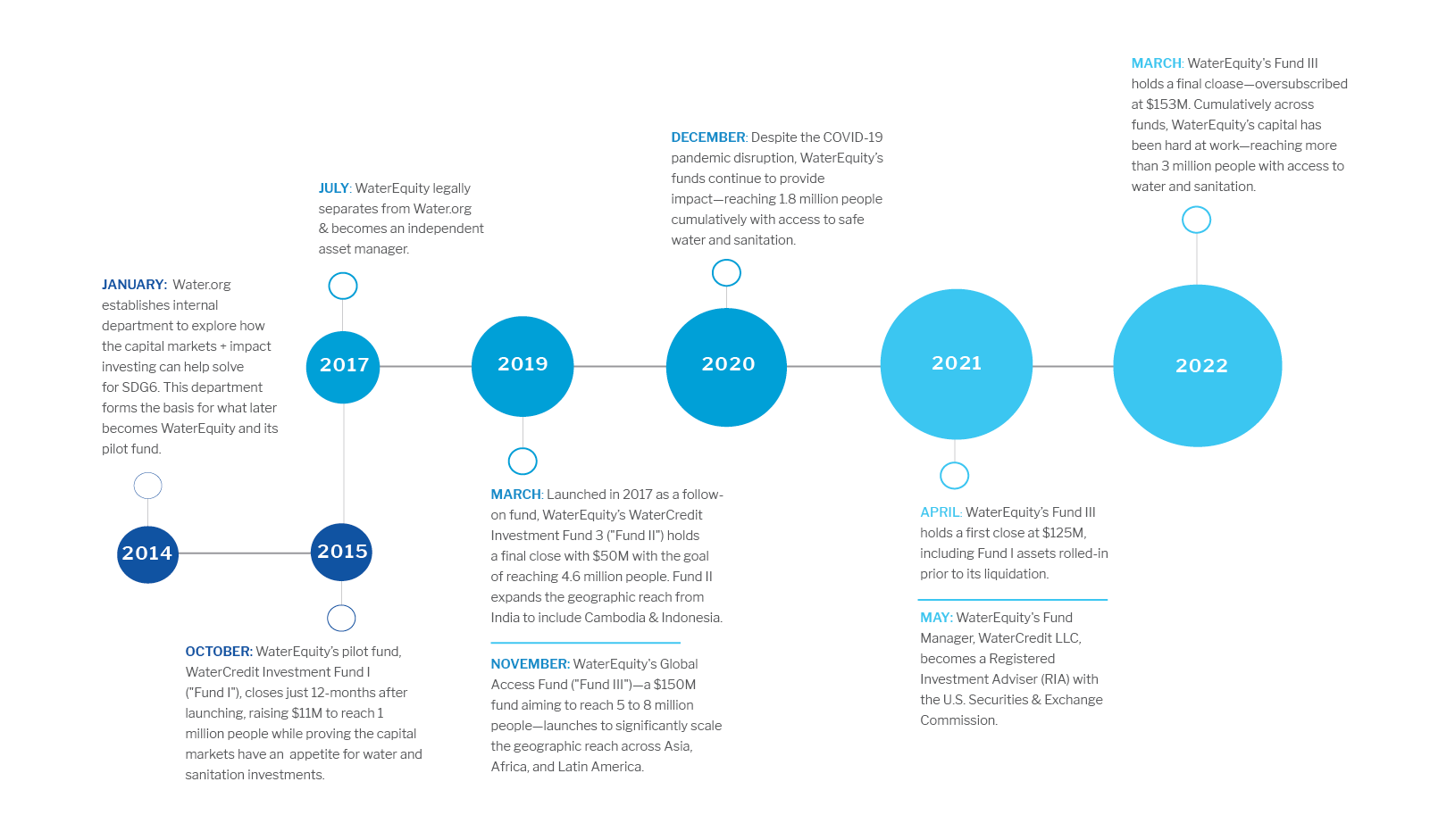

Our team emerged out of Water.org, a renowned, international non-profit that built the case for microfinance for water and sanitation. This helped position us as experts in mobilizing private capital for the water and sanitation needs of emerging consumers.

Fund management excellence.

Proven capability in emerging markets.

Our Journey